TurboTax review

Moneywise.com / Moneywise.com

Updated: January 02, 2024

Many of us feel intimidated at the thought of preparing our own taxes. However, there are a number of tools available to walk you through the process. One of the most respected and complete DIY tax prep software programs available is TurboTax. It’s easy to use — but it’s also one of the more expensive offerings on the market.

Before you buy it, here’s what you need to know.

Cost 4

Customer service4.5

Ease-of-use4.5

Tools and resources4.5

Previous year importing5

Mobile app usability 4.5

TurboTax is one of the oldest DIY tax prep services on the market, and it still shines above the rest. Despite its larger price tag, the features to make tax time easier should put TurboTax at the top of your list.

What is TurboTax?

TurboTax was developed in 1984 and it was one of the first DIY tax preparation software offerings.

TurboTax was purchased by Intuit, the same company that owns QuickBooks and Credit Karma, in 1993.

Today, you can still buy the software in that physical form (or digitally), but online options make it much easier to manage. With a single sign-in, you can access TurboTax across online desktop and mobile platforms, no matter what point you’re at in the process. TurboTax's online filing platform is one of the most comprehensive out there, with a guided flow that makes you feel as though you’re sitting down and talking with a tax professional the whole way through.

Related: Cash App Taxes vs. TurboTax vs. H&R Block

Who is TurboTax good for?

TurboTax is for those who want a little more handholding from their DIY tax prep software. It’s the most feature-rich among options, and it’s one of the easiest to use. If you’re a filer looking for a better value, and you don’t need as many frills, consider cheaper software, such as TaxAct.

However, TurboTax can also be good for a confident tax filer who is pretty sure they can handle a complex tax situation without paying for an accountant — as long as they have some help. Even with the high cost, TurboTax is still less expensive, in many cases, than hiring a CPA to do your taxes for you.

TurboTax features

TurboTax plans and pricing

As with many tax prep programs, TurboTax bases its pricing and products on the complexity of your tax situation and the circumstances you’re in. Some of the things you can expect with TurboTax include:

- Complete integration with QuickBooks, since both are owned by Intuit

- Sidebar navigation keeps you updated on the process and lets you know what you’re missing

- Easy import of W-2 information and the previous year’s tax return

- Maximum refund guarantee

- 100% accuracy guarantee — or TurboTax will pay IRS penalties/interest

- CompleteCheck, which reviews your return before you file

- Extensive knowledge section, including online video tutorials

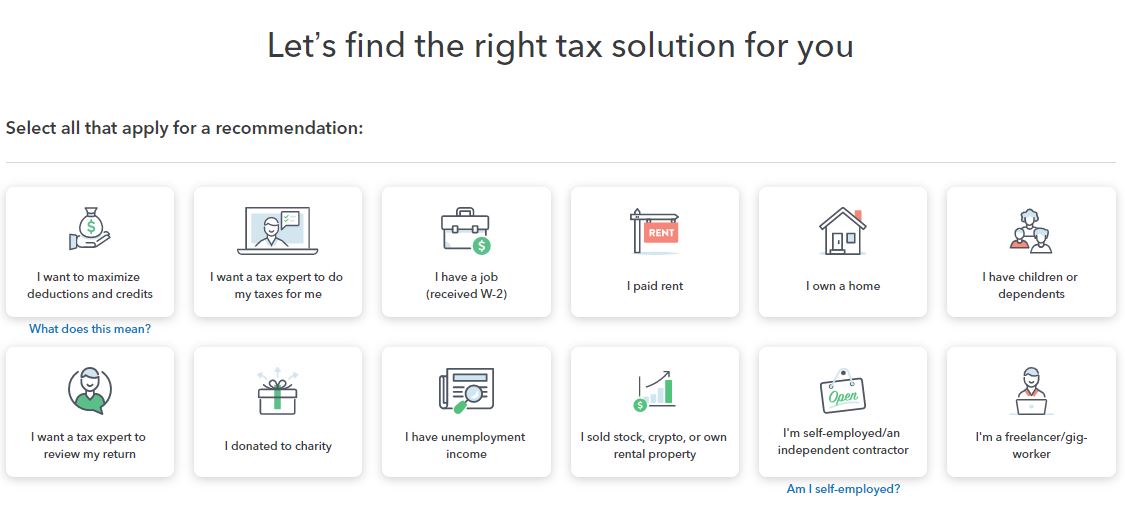

As with many other tax programs, you start by selecting items that reflect your tax situation, including dependents, businesses, investments, and more. You can start the process for free and pay only when you file.

Online services

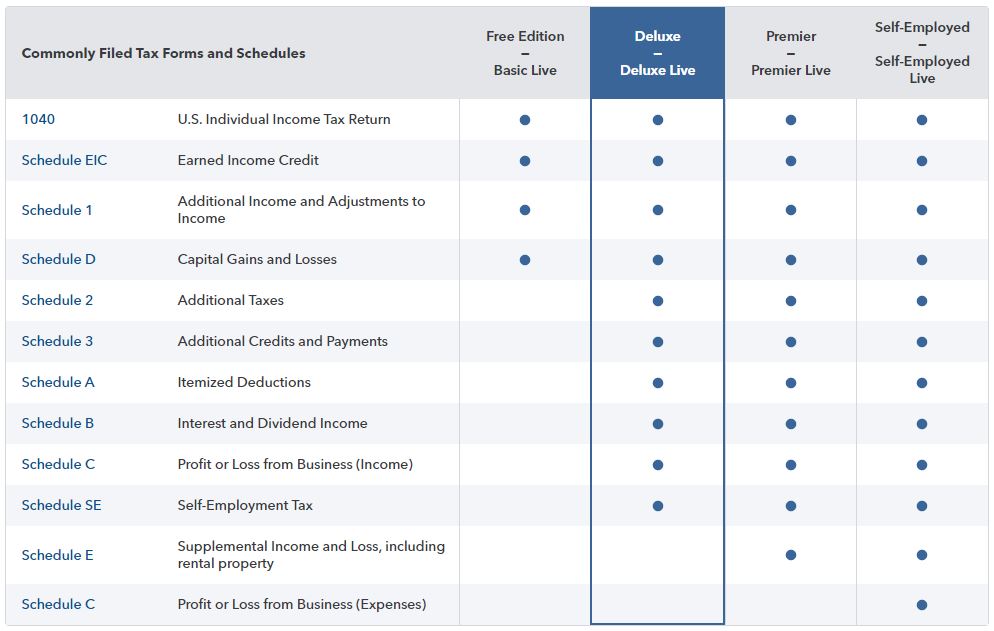

With TurboTax, there are four different types of online filing plans from the most basic to the most complex. These are Basic, Deluxe, Premier, and Self-Employed. For each of these, you can file completely on your own, file with live support as needed from experts (called Live Assist), or have a professional file for you (Live Full Service). As you can imagine, pricing varies substantially for each option.

Free edition

Federal return: starting at $0

State return: starting at $0

Like most other tax prep software, TurboTax offers a free version for those with simple tax returns only. Import your W-2 or last year’s 1040 to get started. This plan includes child credits and EIC. You won’t be able to itemize deductions using Schedule A, report unemployment income, or include earnings from investments on your return. This is best for simple returns.

If you want live help, you can get TurboTax Live Assisted Basic, which gives you on-demand live help online and a review of your form before you file.

No matter which Basic plan you choose, you will only be able to file with Form 1040.

For simple tax returns only. Not all taxpayers qualify.

Deluxe

Federal return: starting at $69*

State return: starting at $59*

With the Deluxe version, you can take more deductions and credits. This includes deductions for student loan interest and education, mortgage interest and property taxes, child and dependent care, and more. You can file a Schedule A form to itemize deductions as well as Schedule B, C, and SE. Deluxe also comes with ItsDeductible, a standalone app for tracking charitable donations.

This plan offers the most benefits for homeowners, families, and people who make donations. If you want to file with live support, Live Assisted Deluxe will cost you $139* for federal filing plus $64* for each state. If you want to pay a pro to file for you, this will cost a minimum of $269*.

Premier

Federal return: starting at $99*

State return: starting at $59*

TurboTax Premier is the version to get if you have rental property and/or investments. You’ll get everything that comes with the Deluxe version (including ItsDeductible), plus a choice from over 450 different deductions. This version can handle crypto transactions, stock sales and purchases, capital gains and losses for a variety of investments, and rental property income. It’s ideal for all kinds of investors.

TurboTax Live Assisted Premier will run you $189* for federal returns and $64* for each state and Live Full Service Premier starts at $379*.

Self-employed

Federal return: starting at $129*

State return: starting at $59*

As you might suspect, the Self-Employed online plan with TurboTax is meant for those who are self-employed or work as contractors. It supports 1099-NEC and 1099-K (also included with Deluxe), Schedule F, Schedule J, and Schedule C filing; offers over 500 different deductions; and integrates with Square, Uber, and Lyft for easy import. With this plan, you’ll also get support calculating depreciation and self-employment taxes for next year and be able to put together as many employee forms as you need.

TurboTax Live Assisted Self-Employed costs $219* plus $64* for every state return while Full Service for Self-Employed starts at $409*.

Software downloads

In addition to online plans, TurboTax has software downloads – but you probably already knew that. For this product, there are four different levels: Basic, Deluxe, Premier, and Home & Business. Basic is the simplest while Home & Business is the most complex.

If you choose the software download instead of the online plan, you’ll install the program on your computer and then file your completed forms. Here are the details for each download.

Basic

Federal return: starting at $50*

State return: starting at $45*

This software is for simple returns using W-2s. It lets you complete up to five federal e-files.

For simple tax returns only. Not all taxpayers qualify.

Deluxe

Federal return: starting at $80*

State return: One state included

TurboTax Deluxe software lets you take up to 350 different deductions and includes an Audit Risk Meter™ to help you gauge your risk of an IRS audit after filing. This download includes five federal e-files and one state return.

Premier

Federal return: starting at $115*

State return: One state included

The Premier tax software download with this provider lets you take deductions for investments and guides you to maximize your refund and IRA tax break next year. Like the Deluxe download, it includes five federal e-files and one state return.

Home and business

Federal return: starting at $130*

State return: One state included

Unlike the other downloads, the Home & Business software download provides support for deducting business expenses and filing self-employed, contract, freelance, and other non-W2 income. The cost includes five federal e-files and one state return.

Related: Taxact vs. TurboTax vs. Taxslayer

How to choose a TurboTax plan

As you can see, TurboTax is pricier than other tax preparation services. Prices change regularly as well, but you don’t have to pay until you finish your return and TurboTax has determined which product you’re actually using (as opposed to the one you started with).

If your bottom line is saving money, go for an online plan rather than a software download unless you have multiple returns to file, and opt to file for yourself. Live Assisted and Live Full Service plans cost significantly more than the DIY plan, and we’ve found that the base plan is easy enough to navigate that many filers will get by fine with the generic support provided. The platform is designed to help self-preparers discover which deductions and credits they may qualify for and which forms they’ll need to fill out, so this is a good option for newbies.

If you have a more complicated tax situation and know you’ll need expert help, you’ll get good value for your money with the Live online plans.

Guarantees

TurboTax tacks several types of guarantees onto its online plans. These are:

- Tax Return Lifetime Guarantee

- 100% Accurate Calculations Guarantee

- Guarantee/Maximum Tax Savings Guarantee – or Your Money Back

- 100% Accurate, Expert-Approved Guarantee

- Backed by our Full Service Guarantee (only for Full Service plans)

- Audit Support Guarantee (this is not the same as audit defense)

- Satisfaction Guarantee

Tax refund options

With TurboTax, you’ll have a number of options for receiving your tax refund. This is common for DIY tax preparation services.

- Direct deposit into your checking, savings, brokerage, or IRA account

- Direct deposit to a Credit Karma Money checking account – receive your refund up to five days early with this option

- Paper check

- Applying to next year’s taxes

You can also pay for your tax prep with your refund.

Getting started with TurboTax

Creating a regular sign-in can allow you to access TurboTax across platforms (desktop and mobile), as well as set you up to use the service for multiple years. Once you have a TurboTax account, the previous year’s information can be used to easily start subsequent tax returns.

You provide an email address, pick a user ID, share your phone number, and create a password. You can verify your account using email or text message. If you also use other Intuit products such as QuickBooks, TurboTax recommends using the same user ID and password for all of them for easy access to different accounts.

Once your account is set up, you’ll go to the tax home page to begin the process of choosing a product. It’s fairly simple and straightforward and lets you get started quickly. If you’re not sure what you need, you can answer some questions and TurboTax will point you in the right direction.

Synchronization

The ability to upload a PDF copy of your 1040 from last year is a nice way to begin populating information. Plus, you can synchronize your use between mobile and desktop seamlessly.

Finally, other DIY tax prep software can sync with QuickBooks, but this integration is stronger with TurboTax since they are both owned by Intuit. This can help you move more quickly through your tax return if you use QuickBooks for business.

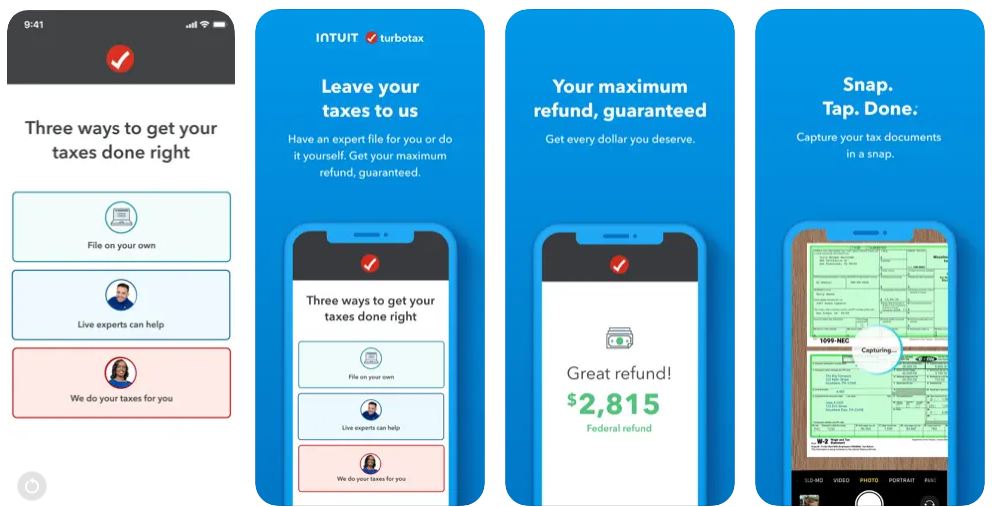

Mobile accessibility

You can get the mobile app for iPhone or Android. You can sign in and use the app to snap images of important documents and even file your taxes on a tablet or phone. If you’re using ItsDeductible, realize that it’s a separate app. You can use the app and connect it to your account, allowing you to track deductions all through the year and import the information to TurboTax.

Customer service

There’s a huge online community for TurboTax, allowing you to ask questions of fellow filers and other TurboTax users. There’s also a searchable knowledge base with video tutorials. You can even use Alexa to check your refund status.

If you want on-demand live help with screen sharing, though, you need to sign up for TurboTax Live. It can get expensive.

However, with the flow of information inside TurboTax as you prepare your taxes, and the extensive knowledge database, unless your tax situation is super complex, the non-Live plan should be more than enough.

Miranda Marquit is a journalism-trained freelance writer and professional blogger specializing in personal finance.

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.